Trust Creation: setting up a Family Bank for success

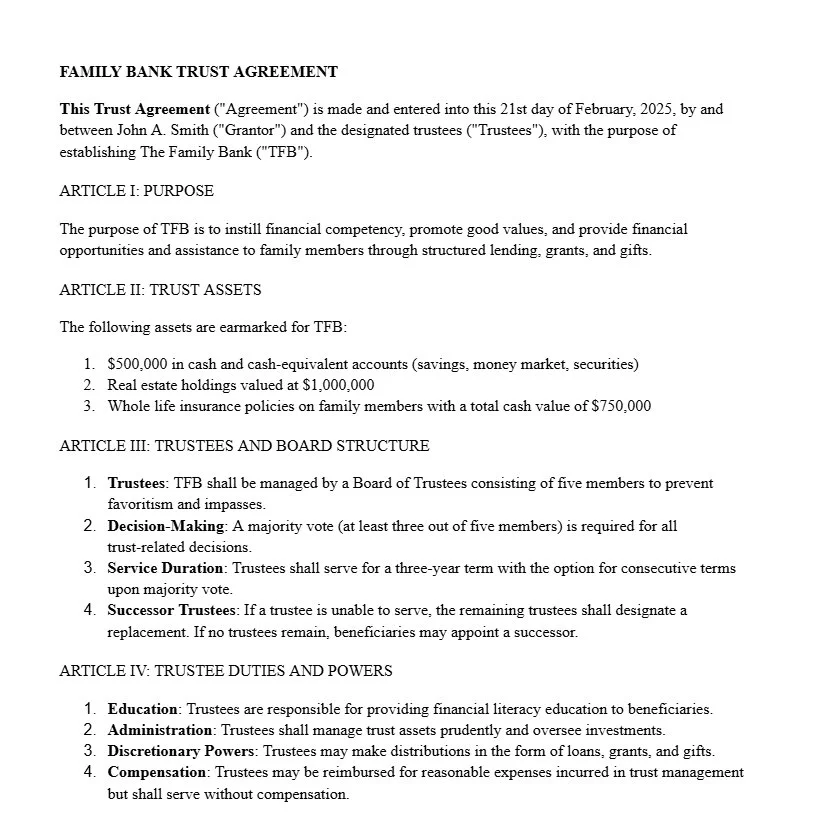

Sample Family Bank Trust Agreement

A Trust …

A trust is the legal framework that helps create a Family Bank. It serves a few key functions:

1. Specifies how a bank will be funded by holding designated assets. These assets could be cash or cash equivalents, properties, stocks, etc. The trust is a safe place to retain these assets for the entire family.

2. Sets operating rules for how the bank will govern itself. This includes listing out family members and what roles they will serve in the bank. The trust establishes the rights and responsibilities of the board members and can guide them in managing the bank.

3. Creates guidelines for how the bank’s resources can be invested. Investment guidance helps the bank’s board to maintain a diverse portfolio and to grow the bank’s resources

4. Explains when loans, grants, and gifts can be offered to the bank members.

Trust guidance for founders

We save founders’ time and money by helping them to consider what would be best for their family before creating legal language.

When a founder meets with an attorney, the attorney creates the language to formalize a founder’s wishes. An attorney can only create this language after the founder has decided how their bank should operate. While an attorney is a competent advisor, an attorney is not trained to advise founders based on their family’s values, strengths, and abilities.

Our approach to trust creation is unique. We help founders to solidify their wishes for their family bank, turning a hope into an executable plan.

Request a consultation

scott@family-legacies-consulting.org

612-859-4149